The AquaPV Techno-Economic Analysis (TEA) tool gives financial metrics for a FPV installation. It considers solar generation, electricity cost, capital investment (CAPEX), operational cost (OPEX), Investment Tax Credit (ITC), Production Tax Credit (PTC), as well as life expectancy and an annual discount rate. You can preview an example result here. To use the tool follow the steps outlined below.

Select a .csv file that has two columns of data; datetime and solar generation in MWs. If you don't have a generation file for your location, you can use the Solar Generation Tool to generate a csv file for your location. Additionally, you can download an example file here.

Select a .csv file that has two columns of data; datetime and price in $/MW. You can download an example file here.

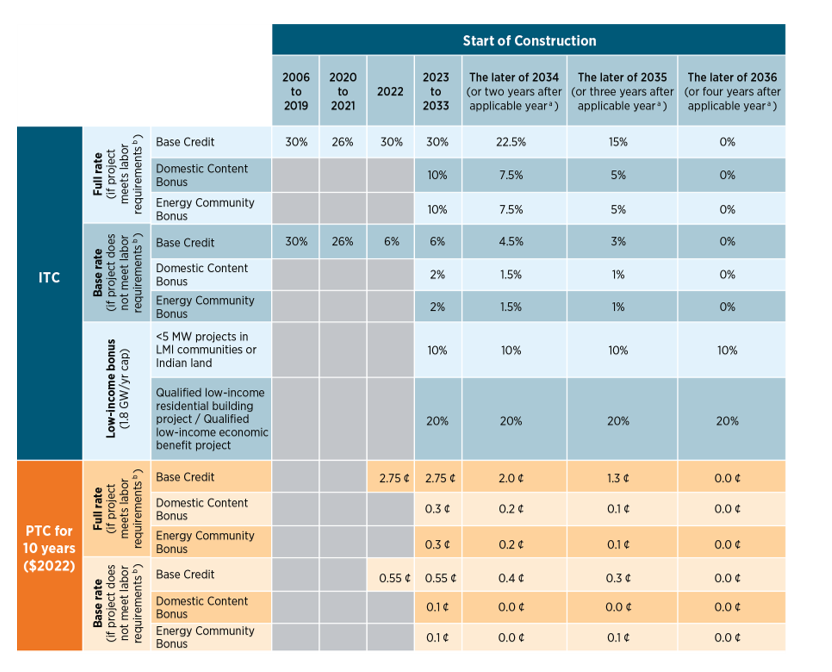

Further information on the ITC and PTC can be found here

You will see the imported data for solar generation and price individually when you import your data. Note: the data has a 1-hour time-step but is plotted with a 10-hour time-step.

Check to make sure the data you input was merged correctly. It should display the number of years used in in the project lifetime. Note: the data has a 1hr time-step but displayed with a 10hr time-steps.

The solar generation revenue is shown with the ITC and PTC incentives as well as with no incentive. The low, baseline, and hight capex/opex are plotted and where the revenue crosses these lines is the payback period time.

The Payback Period measures the amount of time required to recoup the cost of an initial investment via the cash flows generated by the investment. However, payback period does not allow for the time value of money. Note: None is with no project incentives.

The levelized cost of energy (LCOE), also referred to as the levelized cost of electricity or the levelized energy cost (LEC), is a measurement used to assess and compare alternative methods of energy production. The LCOE of an energy-generating asset can be thought of as the average total cost of building and operating the asset per unit of total electricity generated over the projects lifetime.

The net present value (NPV) or net present worth (NPW) applies to a series of cash flows occurring at different times. The present value of a cash flow depends on the interval of time between now and the cash flow. It also depends on the annual effective discount rate. NPV accounts for the time value of money. It provides a method for evaluating and comparing capital projects or financial products with cash flows spread over time.

The return on investment is a ratio between the net income (profit - investments) and the total investment cost. The ROI does not allow for the time value of money.